Common Bookkeeping and Accounting Errors in SMEs

For small and medium-sized enterprises (SMEs), accurate financial records are not just an administrative requirement—they are the backbone of sustainable business growth. Yet, bookkeeping and accounting errors remain one of the most common and costly challenges faced by SMEs across industries. From day-to-day transaction recording to financial reporting and tax compliance, even minor lapses can quietly snowball into serious financial and legal issues.

What makes this more concerning is that many common bookkeeping and accounting errors go unnoticed for months. Over time, these discrepancies can distort cash flow visibility, lead to inaccurate financial statements, trigger unexpected tax liabilities, and expose businesses to penalties or audits. In many cases, SMEs only discover these errors when it is already too late—during tax filings, funding discussions, or regulatory reviews.

These challenges are not rare exceptions. In fact, accounting mistakes are widespread in SMEs due to limited resources, lack of specialized expertise, and reliance on manual processes. Without strong controls and regular reviews, small errors compound quickly, turning manageable issues into operational and compliance risks.

This blog is designed to help SME owners, finance managers, and founders clearly understand where bookkeeping errors and accounting pitfalls typically occur—and, more importantly, how to prevent them. You will gain practical insights and actionable fixes that can help you strengthen financial accuracy, reduce risk, and make more confident business decisions.

Why Bookkeeping & Accounting Errors Are So Common in SMEs

Bookkeeping and accounting challenges are a reality for many small and medium-sized enterprises. While large organizations have dedicated finance teams and structured controls, SMEs often manage their finances with limited resources and evolving processes. This environment makes accounting mistakes in SMEs far more common and explains why these errors continue to affect financial accuracy, compliance, and decision-making. Below are the key reasons behind these issues, explained in a practical and relatable way.

- Limited accounting knowledge among founders is one of the most common reasons for accounting errors. Many business owners lack formal financial training, which increases the likelihood of accounting and bookkeeping errors such as incorrect expense classification or missed accruals.

- Resource constraints further contribute to bookkeeping and accounting mistakes. Limited time, budget, and access to skilled staff force SMEs to operate with minimal oversight, creating a persistent pitfall.

- Rapid business growth without scalable financial systems is another major factor. As transaction volumes increase, outdated processes lead to common accounting and bookkeeping errors.

- Lack of internal controls such as approvals and reconciliations—creates serious accounting pitfalls for businesses, allowing it to go unnoticed and impact financial accuracy.

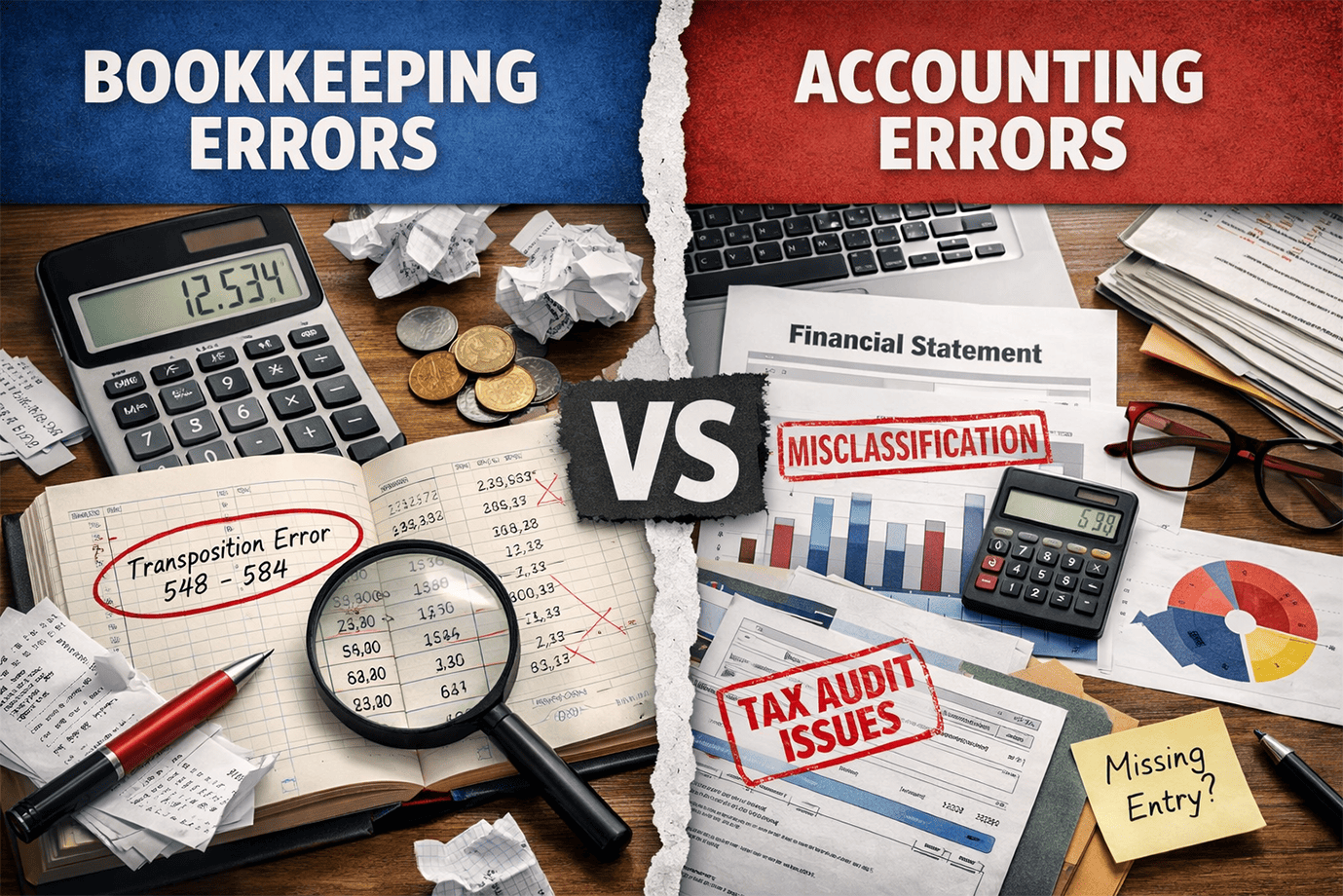

Difference between Bookkeeping Errors and Accounting Errors

Understanding the distinction between bookkeeping and accounting errors is essential for identifying the root cause of financial inaccuracies in a business. While both fall under the broader category of different errors in accounting, they occur at different stages of the financial process and affect decision-making in unique ways.

Meaning

Bookkeeping errors are mistakes that occur while recording day-to-day financial transactions. These errors happen at the data entry level and directly affect raw financial records.

On the other hand, accounting errors occur during the classification, interpretation, and reporting of financial data. They relate to how financial information is summarized and presented.

Stage of Occurrence

Bookkeeping errors occur at the initial stage of recording transactions in journals or accounting software.

While Accounting errors occur at later stages such as ledger adjustments, financial statement preparation, and tax reporting.

Nature of Errors

Bookkeeping errors are transaction-based mistakes such as omissions, duplications, incorrect amounts, or posting entries to the wrong account.

On the other hand, Accounting errors are principle-based or judgment-related accounting mistakes, including incorrect revenue recognition, depreciation errors, or tax miscalculations.

Impact on Financial Records

Bookkeeping errors lead to immediate discrepancies in records such as mismatched balances or inaccurate cash flow.

Accounting mistakes result in misleading financial statements and are among the most common accounting errors affecting compliance and reporting accuracy.

Relation to Compliance

Bookkeeping mistakes primarily affects internal accuracy but can trigger compliance issues if not corrected.

On the other hand, accounting mistakes directly affects regulatory compliance, tax filings, and financial reporting obligations.

Connection between Errors

Unresolved bookkeeping errors often become the root cause of larger accounting errors.

Many common errors in accounting originate from earlier bookkeeping mistakes.

Why It Matters for SMEs

Small bookkeeping errors can quietly accumulate and distort financial data over time.

While accounting errors can lead to penalties, audits, and poor business decisions.

Common Examples

Bookkeeping errors include missing expense entries, duplicate invoices, incorrect expense categorization, and data-entry mistakes.

Accounting errors include misclassifying capital expenses, overstating revenue, incorrect accruals, and applying incorrect accounting standards.

Both types of errors matter equally because they are closely connected. Common errors in accounting often originate from unresolved bookkeeping issues, while accounting misjudgments can amplify the impact of initial recording mistakes. For more detailed information, you can read our comprehensive blog on difference between Bookkeeping vs Accounting.

Most Common Bookkeeping Errors in SMEs

Accurate bookkeeping forms the foundation of reliable financial reporting. However, many small and medium-sized enterprises struggle with recurring bookkeeping mistakes that gradually weaken financial control. These issues often begin at the transaction-recording stage and, if ignored, lead to distorted reports, tax complications, and poor decision-making. Below are the common bookkeeping mistakes seen in SMEs, explained with their causes, risks, and practical prevention measures.

Mixing Personal and Business Finances

One of the most frequent bookkeeping errors in SMEs is the mixing of personal and business transactions. This typically happens when business owners use personal bank accounts or credit cards for business expenses, especially during the early stages of the company.

- Why it happens: Founders often prioritize speed and convenience over structure, assuming they will “sort it out later.” In small teams, this informal approach becomes habitual.

- Risks: Blurring personal and business finances leads to inaccurate profit calculations, unclear cash flow, and increased scrutiny during tax audits. It is one of the most serious mistakes to avoid, as it can also weaken legal and tax compliance.

- How to prevent it: Maintain separate bank accounts and credit cards for business use, establish clear owner-draw policies, and record reimbursements properly instead of mixing transactions.

Delayed or Incomplete Bookkeeping

Another major contributor to common bookkeeping mistakes is postponing bookkeeping tasks until month-end or tax season. When records are updated irregularly, gaps and inaccuracies become unavoidable.

- Backlog issues: Unposted invoices, missing expense entries, and delayed bank reconciliations create large backlogs that are difficult to correct accurately.

- Impact on cash flow and decisions: Delayed records result in outdated financial data, making it hard to track receivables, payables, and available cash. These bookkeeping errors often lead to poor decisions based on incomplete or incorrect information.

- Prevention: Adopt a weekly or monthly bookkeeping routine and use accounting software with automated bank feeds to reduce manual workload.

Failure to Reconcile Bank and Credit Card Accounts

Reconciliations are essential for verifying accuracy, yet many SMEs skip them altogether. This oversight is one of the most overlooked bookkeeping mistakes.

- How reconciliation errors go unnoticed: Without regular reconciliation, duplicate charges, missing deposits, and bank fees remain hidden. Since balances may appear “close enough,” these bookkeeping errors can persist for months.

- Consequences: Unreconciled accounts lead to unreliable cash balances, difficulty detecting fraud, and incorrect financial statements. Over time, these mistakes erode trust in financial reports.

- Prevention: Reconcile all bank and credit card accounts monthly and investigate discrepancies immediately.

Duplicate or Missing Transactions

Duplicate entries and missing transactions are classic common bookkeeping mistakes, especially in businesses relying on manual data entry or multiple data sources.

- Common causes: Manual invoice entry, importing bank feeds incorrectly, or recording both invoices and payments as income can result in duplication. Missing transactions often occur when receipts are lost or cash payments are overlooked.

- How to identify them: Regular reconciliations, transaction reviews, and variance analysis help detect unusual balances and repeated entries.

- Prevention: Standardize data entry processes and use accounting software features that flag duplicates and unmatched transactions.

Incorrect Expense Categorization

Misclassifying expenses is a subtle but impactful bookkeeping error. It often occurs when staff lack clarity on expense categories.

- Capital vs revenue expenses: Recording capital expenditures as operating expenses (or vice versa) is a frequent mistake. For example, equipment purchases may be expensed instead of capitalized.

- Tax implications: Incorrect categorization affects depreciation, taxable income, and financial ratios, increasing the risk of penalties during tax reviews.

- Prevention: Create a clear chart of accounts with examples and review expense classifications regularly.

Poor Record-Keeping and Missing Documentation

Poor documentation is one of the most damaging bookkeeping mistakes to avoid, particularly from a compliance perspective.

- Lost invoices and receipts: Missing source documents make it difficult to verify transactions and justify expenses during audits or tax assessments.

- Compliance risks: Inadequate records can result in disallowed deductions, penalties, and reputational damage. These errors also complicate year-end reporting and audits.

- Prevention: Implement digital document storage, require timely submission of receipts, and maintain organized, searchable records.

For detailed information, you can also read our dedicated blog explaining what is book keeping and its types.

Different Types of Errors in Accounting

Accounting errors go beyond simple data entry issues and usually arise during financial analysis, reporting, and compliance activities. For many small and medium-sized enterprises, these mistakes are harder to detect and often have a wider impact on profitability, taxation, and credibility. Understanding the different types of errors in accounting that frequently affect SMEs helps businesses identify weaknesses in their financial processes and address issues proactively. Below are the most critical and different types of errors in accounting seen in SMEs, explained in detail.

Revenue Recognition Errors

Revenue recognition is one of the most sensitive areas in accounting and a frequent source of accounting mistakes in SMEs.

- Cash vs accrual confusion: Many SMEs struggle to distinguish between cash-based and accrual-based accounting. Recording revenue when cash is received instead of when it is earned is one of the most common errors in accounting. This leads to timing mismatches and creates significant discrepancies in accounting records, especially for service-based businesses.

- Contract and milestone issues: For businesses working with long-term contracts or milestone-based billing, revenue is often recognized incorrectly. Failing to align revenue with performance obligations results in misleading financial statements and is a common example of accounting mistakes at work.

Payroll and Employee Classification Errors

Payroll-related accounting errors are particularly risky because they directly affect compliance and employee trust.

- Contractor vs employee risks: Misclassifying employees as independent contractors is a frequent issue among SMEs. This accounting mistake may reduce short-term costs but can lead to penalties, back taxes, and legal disputes when discovered.

- Payroll tax mistakes: Errors in tax withholdings, benefits calculations, or statutory contributions are among the most damaging small business accounting errors. These mistakes often remain unnoticed until tax authorities raise queries or impose penalties.

Tax Calculation and Filing Errors

Tax compliance is a major pain point and one of the leading causes of SME accounting issues.

- Under- or over-reporting taxes: Incorrect tax calculations result in either underpayment, leading to penalties and interest, or overpayment, which impacts cash flow. These are some of the most frequent accounting errors seen during audits.

- Multi-rate and cross-border issues: Businesses operating across regions face varying tax rates and regulations. Misapplying rates or failing to account for cross-border transactions leads to serious errors in accounting, especially in VAT and GST reporting.

Inventory Valuation Mistakes

Inventory-related accounting errors directly affect profitability and financial ratios.

- Incorrect cost of goods sold (COGS): Errors in calculating COGS—such as excluding certain costs or applying incorrect valuation methods—are common accounting errors that distort gross margins.

- Overstated or understated inventory: Inaccurate stock counts or valuation methods result in inventory being overstated or understated on the balance sheet. These common accounting errors create misleading financial statements and complicate tax reporting.

Fixed Asset and Depreciation Errors

Asset management is another area where accounting mistakes in SMEs frequently occur.

- Not capitalizing assets correctly: Many SMEs expense large purchases instead of capitalizing them as fixed assets. This is one of the most overlooked errors in accounting, leading to incorrect profit figures.

- Wrong depreciation methods: Applying incorrect depreciation rates or methods results in inaccurate expense recognition and creates long-term discrepancies in accounting records.

Ignoring Accruals and Provisions

Accruals and provisions are often ignored by SMEs, yet they are critical for accurate reporting.

- Expenses recorded in the wrong period: Failing to record accrued expenses such as utilities, interest, or professional fees is a frequent accounting error. This results in expenses being shifted to the wrong period.

- Impact on financial statements: Ignoring accruals and provisions leads to misstated profits, inaccurate liabilities, and unreliable financial reports. These accounting errors reduce confidence among lenders, investors, and regulators.

Financial, Legal and Operational Impact of These Errors

Unresolved accounting and bookkeeping errors can have far-reaching consequences for small and medium-sized enterprises. What may begin as minor recording issues often evolves into serious financial, legal, and operational challenges when bookkeeping and accounting mistakes are left unaddressed. Understanding the impact of these errors highlights why timely correction and strong financial controls are essential.

- Cash flow mismanagement: Inaccurate records caused by bookkeeping errors distort cash flow visibility. When incoming and outgoing funds are not properly tracked, businesses struggle to meet obligations, plan expenses, or identify liquidity gaps.

- Tax penalties and interest: Incorrect calculations, missed filings, or misclassified expenses resulting from accounting errors often lead to underpaid taxes. This exposes SMEs to penalties, interest charges, and increased scrutiny from tax authorities.

- Poor decision-making: Financial decisions based on flawed reports created by bookkeeping and accounting mistakes can result in overinvestment, cost overruns, or missed growth opportunities. Inaccurate data weakens strategic planning and forecasting.

- Reduced investor and lender confidence: Investors and lenders rely heavily on accurate financial statements. Persistent accounting errors or unexplained discrepancies reduce credibility and can limit access to funding or financing on favorable terms.

- Compliance and audit risks: Ongoing bookkeeping errors increase the likelihood of audit findings, restatements, and regulatory non-compliance, potentially damaging both finances and reputation.

Addressing bookkeeping and accounting mistakes early helps protect financial stability and supports sustainable business growth.

Warning Signs and Preventive Measures: How SMEs Can Identify and Avoid Bookkeeping & Accounting Errors

For many business owners, financial problems rarely appear suddenly. They usually build up over time through unnoticed bookkeeping mistakes and unresolved accounting errors. Understanding the early warning signs—and knowing how to act on them—is critical for SMEs that want to avoid long-term financial stress. This section helps you first diagnose potential issues in your business and then explains how to prevent common accounting and bookkeeping mistakes through practical, proven measures.

Warning Signs Your SME Has Bookkeeping or Accounting Errors

Many accounting mistakes in SMEs remain hidden until they begin to affect cash flow, taxes, or compliance. The following warning signs often indicate accounting and bookkeeping errors that already exist within your records:

- Frequent cash-flow surprises: If your actual bank balance does not match what your reports show, it is usually due to bookkeeping errors such as missing entries, delayed updates, or duplicate transactions. These are classic common mistakes that disrupt cash planning.

- Unreconciled accounts: Bank and credit card accounts that are not reconciled regularly often conceal discrepancies in accounting. This is a common mistake that allows small errors to accumulate unnoticed.

- Tax liabilities higher than expected: Unexpected tax bills frequently result from common accounting errors, including incorrect expense categorization, missed accruals, or misapplied tax rates. These accounting mistakes at work can strain cash reserves.

- Inconsistent financial reports: Large fluctuations in profit or expenses without a clear operational reason often signal common errors in accounting. Inconsistent reports usually point to unresolved mistakes.

- Negative audit or advisor feedback: Repeated corrections or audit observations highlight persistent small business accounting errors that need immediate attention.

Recognizing these signs early allows SMEs to address issues before they escalate into major accounting issues.

How SMEs Can Prevent Bookkeeping & Accounting Errors

Once warning signs are identified, prevention becomes the next priority. Avoiding accounting mistakes requires a proactive approach built on processes, technology, and expert oversight.

- Implement Proper Financial Processes: Structured financial processes are essential for reducing accounting errors. Monthly closing procedures ensure all transactions are recorded, reviewed, and approved on time. Clearly defined approval workflows help prevent unauthorized or incorrect entries, reducing accounting pitfalls for businesses caused by rushed reporting.

- Use the Right Accounting Software: Modern accounting software plays a key role in minimizing book keeping errors. Automation reduces manual data entry, which is one of the leading causes of accounting errors such as duplication or omission. Integration with payroll, inventory, and tax systems further reduces discrepancies in accounting and improves accuracy across functions.

- Regular Reconciliations and Reviews: Monthly and quarterly reconciliations act as a safety net against common accounting mistakes. Reconciling bank accounts, receivables, payables, and tax balances helps detect errors early and prevents small issues from becoming major mistakes in SMEs.

- Segregation of Duties—Even in Small Teams: Even with limited staff, separating responsibilities for recording, approving, and reviewing transactions significantly reduces risk. This control is one of the most effective ways to avoid bookkeeping mistakes and reduce fraud-related accounting pitfalls.

- Outsourcing or Professional Support: As businesses grow, internal teams may struggle to keep up with compliance and reporting demands. Engaging professional accountants or bookkeepers helps SMEs avoid recurring common bookkeeping mistakes and complex accounting errors. External experts bring clarity, ensure regulatory compliance, and help correct accounting errors before they impact financial health.

- Why Early Action Matters: Ignoring warning signs and delaying corrective action allows bookkeeping and accounting mistakes to compound over time. Proactive financial management—supported by strong processes, the right tools, and professional expertise—helps SMEs reduce common accounting errors, maintain compliance, and make confident, data-driven decisions.

By identifying risks early and implementing preventive measures, businesses can protect themselves from avoidable SME accounting issues and build a resilient financial foundation for sustainable growth.

Conclusion:

Throughout this blog, we’ve explored how bookkeeping and accounting errors can quietly undermine even well-intentioned SMEs. Understanding the different types of errors in accounting and bookkeeping—and acting early—is essential for maintaining accurate financial records, avoiding costly penalties, and making sound business decisions. Ignoring these issues often leads to discrepancies in accounting, distorted financial reporting, and operational challenges that could easily have been prevented with proactive measures.

For small business owners, recognizing common accounting errors and bookkeeping mistakes is the first step toward financial discipline. Whether it’s addressing delayed entries, misclassification of revenues, or failing to reconcile accounts, these challenges represent accounting pitfalls for businesses that can be corrected with improved processes and professional support. Avoiding these mistakes in SMEs is not just about accuracy—it’s about building a foundation of trust, compliance, and sustainable growth.

That’s where expert support becomes invaluable. Regular reviews and expert support like Kamvisors Global LLP can help SMEs stay compliant and financially healthy. Kamvisors Global LLP is a trusted finance and tax consultancy offering comprehensive services in accounting, bookkeeping, taxation, compliance, and business advisory designed specifically for growing enterprises. With a team of experienced professionals, they provide tailored outsourcing solutions for bookkeeping, payroll, and MIS reporting that help businesses avoid common accounting and bookkeeping errors and focus on strategic growth.

Acting early to correct these errors, implementing systematic controls, and engaging with expert partners like Kamvisors can transform your financial management from reactive to proactive. Visit our Homepage to explore how their services can support your SME in avoiding costly bookkeeping and accounting mistakes and strengthening financial health for the long term.

Frequently Asked Questions (FAQs)

Q1. What are the common bookkeeping and accounting errors in SMEs?

A. The common bookkeeping errors include delayed or inaccurate transaction recording, missing or duplicate entries, incorrect expense categorization, and poor record-keeping. On the accounting side, common accounting errors involve revenue recognition issues, payroll and tax mistakes, inventory valuation errors, and missed accruals. These mistakes often lead to discrepancies like cash-flow issues, and compliance risks if not addressed early.

Q2. How do bookkeeping errors differ from accounting errors?

A. Bookkeeping errors occur at the transaction-recording level, such as missing entries or duplicate transactions, while accounting errors relate to reporting, compliance, and application of accounting principles. Both are of different types and can create serious discrepancies if left uncorrected.

Q3. Why are accounting mistakes in SMEs so common?

A. Accounting mistakes in SMEs are common due to limited accounting knowledge, budget constraints, reliance on manual systems, and lack of internal controls. These challenges create issues and increase exposure to compliance risks.

Q4. What are the warning signs of discrepancies in accounting?

A. Common warning signs of discrepancies in accounting include frequent cash-flow surprises, inconsistent financial reports, unreconciled bank accounts, and unexpected tax liabilities.

Q5. How can SMEs avoid bookkeeping and accounting mistakes?

A. SMEs can avoid bookkeeping and accounting mistakes by implementing structured financial processes, using accounting software, conducting regular reconciliations, and seeking professional support. These steps significantly reduce accounting errors and improve financial accuracy.

Leave A Comment